A trio of men were arrested on multiple charges of operating a Ponzi scheme, the funds from which the gentlemen used to buy nine homes, 26 luxury cars, a boat, jewelry, and a share in a private jet, all the while telling their clients/victims that the money was being used to buy consumer debt portfolios.

Kevin B. Merrill (53), Jay B. Ledford (54), and Cameron R. Jezierski (28) face decades in federal prison if they are found guilty.

From a statement issued by the United States Attorney's Office in the District of Maryland:

According to the fourteen-count indictment, beginning in January 2013, the defendants perpetrated a Ponzi scheme to defraud investors of more than $364 million. The scheme was revealed with the arrests and unsealing of the indictment. Specifically, the indictment alleges that Merrill and Ledford invited investors to join them in purchasing consumer debt portfolios. “Consumer debt portfolios” are defaulted consumer debts to banks/credit card issuers, student loan lenders, and car/truck financers which are sold in batches called “portfolios” to third parties which attempt to collect on the debts. The defendants falsely represented to investors that they would use the investors’ money to buy consumer debt portfolios and make money for them by (1) collecting the payments that people made on their debts or (2) selling the portfolios for a profit to third party debt buyers--in a practice called “flipping.” According to the related complaint filed by the SEC, the victim investors included small business owners, restauranteurs, construction contractors, retirees, doctors, lawyers, accountants, bankers, talent agents, professional athletes, and financial advisors, located in Maryland, Washington, D.C., Northern Virginia, Las Vegas, Texas, and elsewhere.

The indictment alleges that in order to induce investors to participate, the defendants falsely represented who they were buying the debt portfolios from and how much they were paying for the portfolios; whether they were investing their own funds, and their track record of success. At times, according to the indictment, there was no underlying debt portfolio purchased with the investors’ money. To conceal the truth, the defendants created imposter companies with names similar to actual consumer debt sellers or brokers and opened bank accounts in the names of those imposter companies. In addition, to lend credibility to the transactions, the defendants created false portfolio overviews, sales agreements which used the names and forged signatures of actual employees of the sellers, created false collections reports, and falsified bank wire transfer records and bank statements.

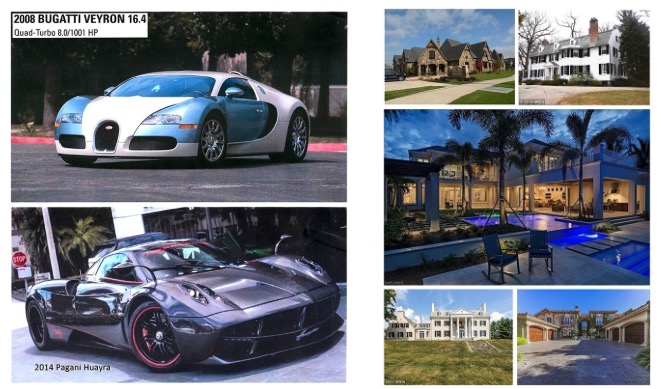

Further, the indictment alleges that the defendants falsely represented that the monies they paid to investors were “proceeds” from collections and/or flipping debt portfolios, when in fact, the proceeds were paid from funds provided by other investors. The indictment alleges that Merrill, Ledford, and Jezierski personally enriched themselves and concealed their diversion of $73 million of investors’ funds to purchase and renovate high end homes in Maryland, Texas, Nevada, and Florida, purchase luxury automobiles, jewelry, boats, and a share in a jet plane, gamble $25 million at casinos, and support a lavish lifestyle.

The indictment seeks to forfeit nine properties, 26 luxury cars, one boat, interest in an aircraft, a life insurance policy, seven and nine carat diamond rings, and a 23 carat diamond bracelet, which were allegedly purchased with proceeds of the scheme to defraud.

Image: US Attorney's Office